Global Market Square NVIDIA’s Meteoric Increase to $3.335 Trillion Market Cap Propels S&P 500; Consumer Spending Holds Steady Supporting Continued Economic Growth in 2024

Yesterday, the S&P 500 soared to a new record high. International markets also showed strength, driven by central bank actions and political uncertainties in France. Improved growth prospects in Europe and potential easing from major central banks have brightened the outlook for developed international markets.

In the bond market, interest rates were steady today. However, June saw significant movement, with the 10-year Treasury yield dropping from 4.6% to below 4.22% over the last 14 trading days. This decline is attributed to slowing economic momentum and a softer-than-expected inflation report for May, indicating that the core CPI is at its lowest in three years. While we don’t expect yields to drop dramatically, we anticipate a gradual moderation in longer-term rates throughout the year, driven by an eventual Fed rate cut and continued signs of modest economic growth. This environment should support better bond returns, though we maintain an overweight recommendation on equities, expecting lower rates to provide an even more significant boost to stocks, as has been the case in 2024. The latest retail sales report highlighted a slight pullback on the consumer front. Overall retail sales increased by a modest 0.1% in May compared to April, bolstered by a rebound in vehicle sales. Lower gas prices and weak building material sales weighed on the results. However, the control group figure, which excludes autos, gasoline, and building materials to reveal underlying spending trends, rose 0.4% for the month, following a particularly weak April. This data suggests that while consumer spending is set to slow this year, it is doing so from a strong growth level. This will lead to moderate GDP growth. As long as job growth and unemployment around 4% persist, we expect consumer spending to remain robust enough to support ongoing economic and corporate earnings growth through 2024.

GDPNow Update:

- The GDPNow for the second quarter of 2024 was updated on June 18 and is unchanged at 3.10%.

Key Economic Data:

- U.S. Retail and Food Services Sales MoM: rose by 0.09%, compared to -0.18% last month.

- U.S. Retail and Food Services Sales (Excluding Motor Vehicle and Part Dealers) MoM: is at -0.09%, compared to -0.13% last month.

- N.Y. Fed Business Leaders Survey Current Business Activity: fell by -4.70, down from 3.00 last month.

- U.S. Industrial Production MoM: rose to 0.85%, compared to 0.01% last month.

- U.S. Business Inventories MoM: rose by 0.30%, compared to -0.13% last month.

- U.S. Wholesalers Inventories MoM: rose by 0.15%, compared to -0.48% last month.

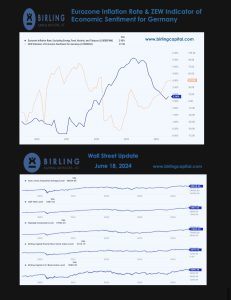

- Eurozone Inflation Rate: Excluding Energy, Food, Alcohol, and Tobacco: rose 2.90%, compared to 2.70% last month.

- ZEW Indicator of Economic Sentiment for Germany: rose to 47.50, up from 47.10 last month.

Eurozone Summary:

- Stoxx 600: closed at 515.01, up 3.52 points or 0.69%.

- FTSE 100: closed at 8,191.29, up 49.14 points or 0.60%.

- Dax Index: closed at 18,131.97, up 63.76 points or 0.35%.

- Dow Jones Industrial Average: closed at 38,834.66, up 56.76 points or 0.15%.

- S&P 500: closed at 5,487.03, up 13.80 points or 0.25%.

- Nasdaq Composite: closed at 17,862.23, up 5.21 points or 0.03%.

- Birling Capital Puerto Rico Stock Index closed at 3,274.15, up 32.77 points or 1.01%.

- Birling Capital U.S. Bank Stock Index closed at 5,080.38, up 53.95 points or 1.07%.

- U.S. Treasury 10-year note closed at 4.22%.

- U.S. Treasury 2-year note closed at 4.69%.